Over the past 18 months, Australians have endured significant economic challenges, including what has been described as a “per capita recession.” However, recent data reveals that consumer confidence is steadily improving, signaling a potential shift in the housing market and broader economy.

The Upswing in Consumer Sentiment

According to the Westpac Consumer Sentiment Index, Australians are becoming cautiously optimistic about their finances and the economic outlook. The index has seen two consecutive monthly increases, approaching a neutral level for the first time since the post-COVID-19 recovery.

As Matthew Hassan, a senior economist at Westpac, notes, this renewed optimism reflects a significant change in consumer behaviour. Interestingly, survey respondents are also more inclined to believe now might be a good time to buy a property, with the sentiment jumping 11% this month to its highest level in three years.

Implications for the Housing Market

This boost in confidence comes with both opportunities and challenges. For potential buyers, the improving sentiment offers a much-needed morale boost. Average mortgage sizes are on the rise, indicating renewed activity in the property market. Sydney and Melbourne, despite their recent downturns, are seeing shifts in buyer behaviour driven by improved consumer confidence.

However, this optimism could complicate efforts by the Reserve Bank of Australia (RBA) to control inflation. Rising consumer confidence and spending might delay anticipated interest rate cuts, keeping financial pressures high for many Australians.

Opportunities in the Property Market

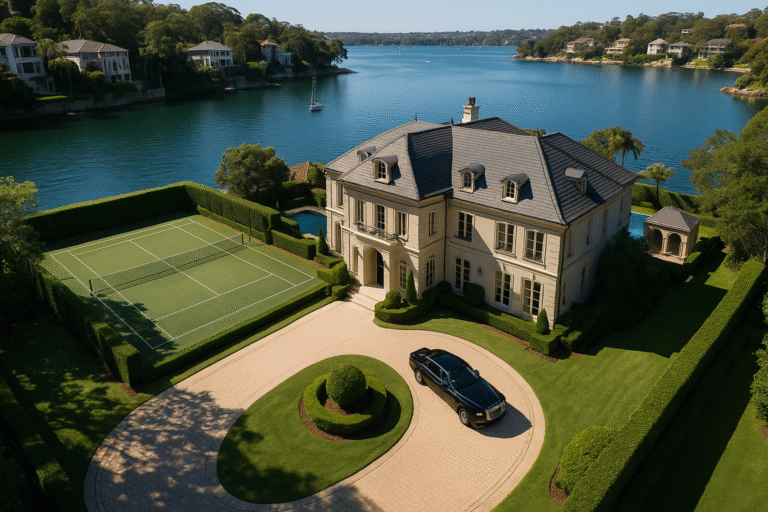

Despite the challenges, current market conditions present strategic opportunities, especially for buyers focused on quality properties in high-demand areas. As highlighted in recent CoreLogic data, while some unit markets in Sydney and Melbourne remain below their pre-COVID peaks, the demand for well-located, high-quality properties is expected to rise.

Experts advise targeting boutique developments, architecturally significant blocks, or properties in areas with limited new supply. This strategic approach ensures that buyers are well-positioned to capitalize on counter-cyclical opportunities in the market.

Affordability Still a Key Concern

While confidence is improving, housing affordability remains a pressing issue. The ANZ/CoreLogic Housing Affordability Report highlights that it now takes an average of 10.6 years to save for a 20% deposit on a median-priced home. Rising house prices and high interest rates have created a challenging environment for first-home buyers, particularly those without access to intergenerational wealth.

The Rental Market Shows Signs of Relief

In the rental sector, vacancy rates have improved for the first time in 16 months. PropTrack data shows a rise in rental properties available nationwide, driven by increased investor activity and renters transitioning to share housing or homeownership. While supply remains below pre-pandemic levels, these trends indicate a gradual easing of pressure in the rental market.

Looking Ahead

As Australians regain confidence, the property market stands at a crossroads. Buyers and investors have opportunities to make strategic moves, but affordability and inflation remain critical factors to watch.

Real Estate Newsletter

This article is a curated summary of various news stories from the past week, offering insights and updates on the real estate market. 22 November 2024