The Sydney real estate market, which has shown remarkable resilience and growth in recent years, experienced its first monthly dip in house prices since the start of 2023. The CoreLogic data released for October indicates a modest 0.1% drop, reflecting a broader cooling trend also seen in Melbourne and other Australian cities. This shift has sparked interest among potential buyers and investors as Sydney’s median home value now stands at approximately $1.48 million, highlighting the persistent challenge of affordability.

Factors Influencing Sydney’s Market Decline

The slight decrease in house prices comes amidst a backdrop of slowed population growth and an increase in housing supply. CoreLogic notes that Sydney’s property listings are 13% above their long-term average, offering buyers greater options than in previous years. This trend aligns with the recent 4.4% rise in housing approvals in September, suggesting an expanding supply of housing stock that may help alleviate pressure on Sydney’s high property values.

Rental Market Softening

In addition to home prices, the rental market has shown signs of relief with rent declines in Sydney and other major cities. This trend can be attributed to a tapering in overseas migration and an increase in average household sizes, which had decreased sharply during the COVID-19 pandemic. However, rents are still experiencing year-over-year inflation, with September’s rate slowing to 6.6%, down from a 7.1% increase in June.

Regional Performance: Eastern Suburbs Surge, Inner West Declines

Sydney’s housing market is revealing a varied performance across different regions:

- Eastern Suburbs saw the city’s highest quarterly growth at 2.36%, fueled by strong demand from upgraders with significant home equity.

- Inner West and CBD/Inner South experienced modest declines, with a 1.18% and 0.38% drop, respectively, suggesting these areas might be reaching a price peak amid growing market hesitation.

Economic Implications and Buyer Sentiment

With interest rates still high and inflation pressures easing, buyer sentiment remains cautious. Though housing supply has improved, many buyers are waiting for potential rate cuts before making purchase decisions. However, if the RBA holds rates steady for longer, Sydney’s market could face another wave of price adjustments as more homeowners may be compelled to sell, increasing available stock further.

Long-Term Investment Insight

While house prices have shown robust growth over the past decade (up by 94.6%), unit prices lag behind, with just a 34.6% increase in the same period. Experts highlight Sydney’s constrained geography as a key driver of the high demand for houses over units. This demand disparity, coupled with the ongoing growth in housing supply, emphasizes the need for careful planning and a diversified approach to property investments, such as targeting low-density unit developments in established areas with limited new apartment supply.

Conclusion

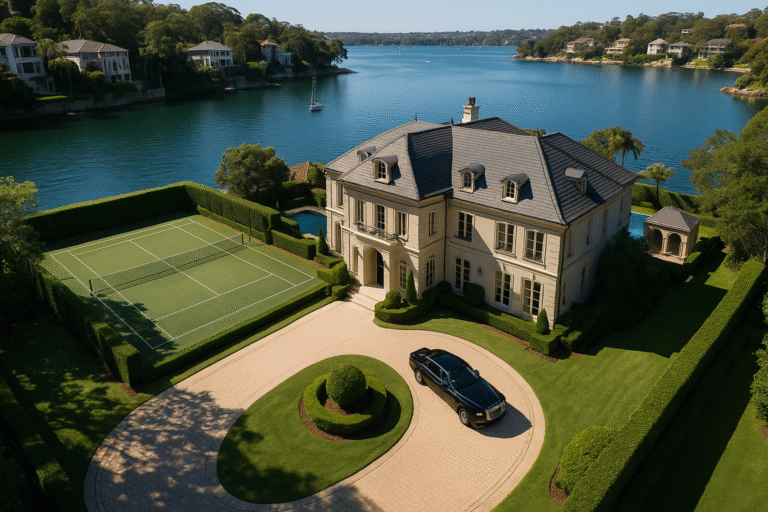

For buyers and investors, Sydney’s current market offers a unique opportunity to leverage increased listings and a softening rental market. The potential for future rate cuts could stabilize prices and stimulate growth, while high-end suburbs like the Eastern Suburbs continue to show resilience and value appreciation. As the market evolves, adapting strategies to regional trends will be crucial for those looking to make informed and advantageous property decisions in Sydney.

Real Estate Newsletter

This article is a curated summary of various news stories from the past week, offering insights and updates on the real estate market. 1 November 2024